Get flexible payment options

For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR

For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR

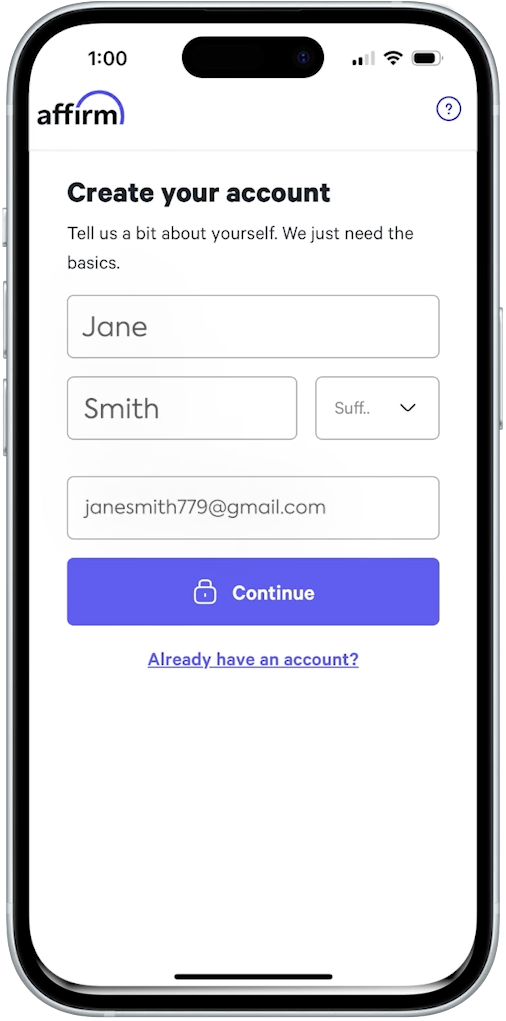

Forno Bravo Will Send You A Custom Link To Apply For Financing.

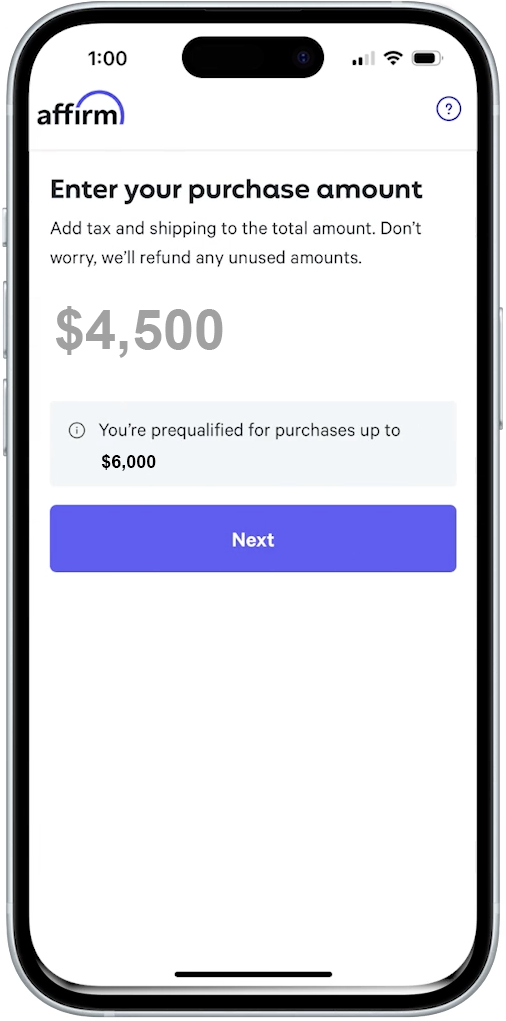

Check Forno Bravo Estimate & Decide How Much to Finance

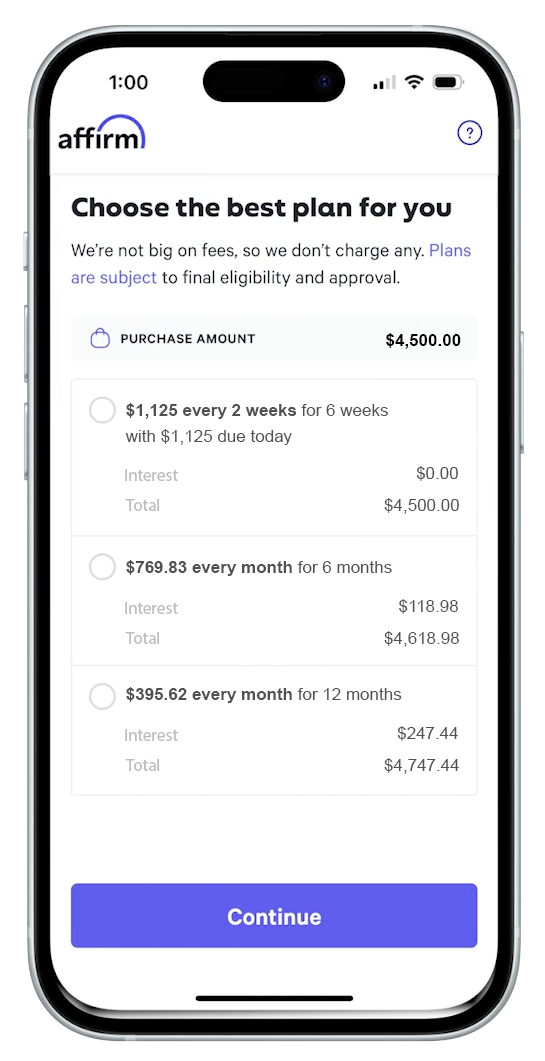

Determine What Payment Plan & Interest Rate Is Right For You.

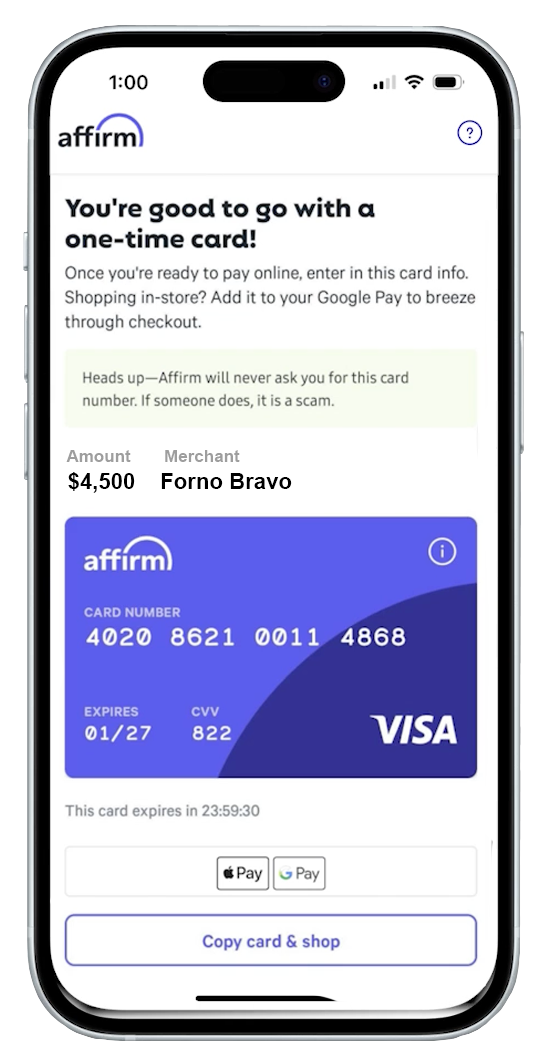

Call Your Forno Bravo Rep to Finish Purchase Using Affirm Virtual Card

With Affirm, you always know exactly what you’ll owe and when you’ll be done paying.

Affirm tells you the total amount you’ll pay up front. That number will never go up.

You choose the payment schedule that works best for you.

Affirm doesn’t charge late fees or hidden fees of any kind, ever.

Rates from 0–36% APR. For example, a $800 purchase might cost $72.21/mo over 12 months at 15% APR. Payment options through Affirm are subject to an eligibility check, may not be available everywhere, and are provided by these lending partners: affirm.com/lenders. Options depend on your purchase amount, and a down payment may be required. Estimated payment amount may exclude taxes and shipping. CA residents: Loans by Affirm Loan Services, LLC are made or arranged pursuant to a California Financing Law license. For licenses and disclosures, see affirm.com/licenses.

The one-time-use Affirm virtual card is issued by Sutton Bank, Member FDIC, or Celtic Bank, pursuant to a license from Visa U.S.A. Inc.

Yes, there’s no penalty for paying early.

You can make or schedule payments at affirm.com or in the Affirm app for iOS or

Android. Affirm will send you email and text reminders before payments are due.

Yes, you can return an item you bought with Affirm by initiating the return process

with the store.

No, your credit won’t be affected when you create an Affirm account or check your

eligibility (including checking your pre qualification eligibility). When you apply for or

check to see if you prequalify for Affirm financing, it’s considered a soft inquiry,

which does not affect your credit. If you decide to pay with installments through

Affirm, your payment plan and repayment activity may be reported to credit

bureaus.

You can find more information on Affirm’s Help Center.

Yes, you’ll need a mobile phone number from the U.S. or U.S. territories. This helps

Affirm verify it’s really you who is creating your account and signing in.

You can visit their website at affirm.com.